Disclaimer:

The information on this website is for general guidance only and does not constitute financial or investment advice. Always do your own research and seek personalised advice from a qualified financial adviser or mortgage adviser before making financial decisions. All investments carry risk and past performance is not indicative of future results.

Key Takeaways

- A meaningful deposit plus good saving habits signals financial readiness.

- Stable, predictable income gives banks confidence to lend.

- Reducing personal debt can dramatically improve your borrowing capacity.

- Mental and emotional readiness is just as important as financial preparation.

- Clarity on affordability and a realistic buying plan turns uncertainty into action.

For many first home buyers in New Zealand, the idea of buying a home can feel both exciting and overwhelming at the same time. You might be watching the market closely, browsing listings, and imagining what it would be like to finally have a place of your own. At the same time, you may be unsure whether now is truly the right time to take that step.

Readiness is not just about whether you can technically get a mortgage approval. It is about whether your finances, your lifestyle, and your expectations are aligned with the realities of home ownership. Buying too early can place unnecessary pressure on your budget and mental wellbeing. Waiting too long can mean missing opportunities that may have suited your life perfectly. The goal is not to time the market perfectly, but to understand your own readiness clearly.

The following five signs provide a grounded framework to help you assess whether you are in a strong position to move forward with buying your first home in New Zealand. If you can confidently relate to most of these, you are likely closer to being ready than you think.

1. You Have a Meaningful Deposit, With a Clear Path Forward

One of the most common questions first home buyers ask is, "How much deposit do I actually need?" In an ideal world, a 20 percent deposit is the gold standard. It typically unlocks sharper interest rates, broader bank options, and avoids low equity margins. However, for many first home buyers in New Zealand, especially in higher-priced regions, waiting until you reach 20 percent can feel like an impossible goal.

In practice, many buyers enter the market with around 10 percent, and in some cases as little as 5 percent may be possible through specific bank criteria, government-backed First Home Loan schemes, or developer-supported new build purchases. What matters most is not just the number, but the sustainability of your position after you buy. If stretching to a low deposit means you have no buffer for rates rising, maintenance costs, or lifestyle changes, you may technically be able to buy, but you may not be financially comfortable.

A strong sign of readiness is not simply having a deposit sitting in your account, but understanding how that deposit interacts with your overall buying power. This includes knowing how much you can realistically borrow, what purchase price range you should focus on, and how much you need to hold back for costs such as legal fees, building reports, valuations, and moving expenses. Many first home buyers underestimate these additional costs and accidentally push themselves into a tighter position than planned.

Being deposit-ready also means you have formed good saving habits. The discipline required to build a deposit is often the same discipline needed to manage a mortgage long-term. If you have demonstrated that you can consistently set aside money while still living your life, you are already building the habits that home ownership will demand.

2. You Have Regular and Stable Income That Banks Can Rely On

A deposit alone is not enough to secure a mortgage. Banks are ultimately lending based on confidence in your ability to service repayments over many years. Regular and stable income is one of the strongest indicators that you are ready to buy your first home.

Stability does not necessarily mean you must have been in the same job for decades. It means your income is predictable, ongoing, and well-documented. For salaried employees, this is often straightforward. For contractors or self-employed buyers, readiness may come down to whether you have enough income history, usually two years of financials, to show consistency and sustainability.

Being income-ready also means your income supports the lifestyle you want after you buy. It is one thing to qualify for a loan on paper. It is another to feel comfortable making repayments while still enjoying life. A good sign of readiness is when your projected mortgage repayments fit within your budget without forcing you to sacrifice everything that matters to you. If buying a home would leave you constantly stressed about money, the timing may be financially possible but emotionally premature.

It is also worth noting that banks apply conservative assumptions to expenses and future rate movements. Your real-world experience may feel manageable now, but approvals are stress-tested at higher interest rates. Being ready means understanding that your repayments today are unlikely to be your repayments forever, and ensuring your income has enough breathing room to cope with changes over time.

Need personalised guidance?

Chat with a First Home Buyers Club affiliated mortgage adviser - no obligation!

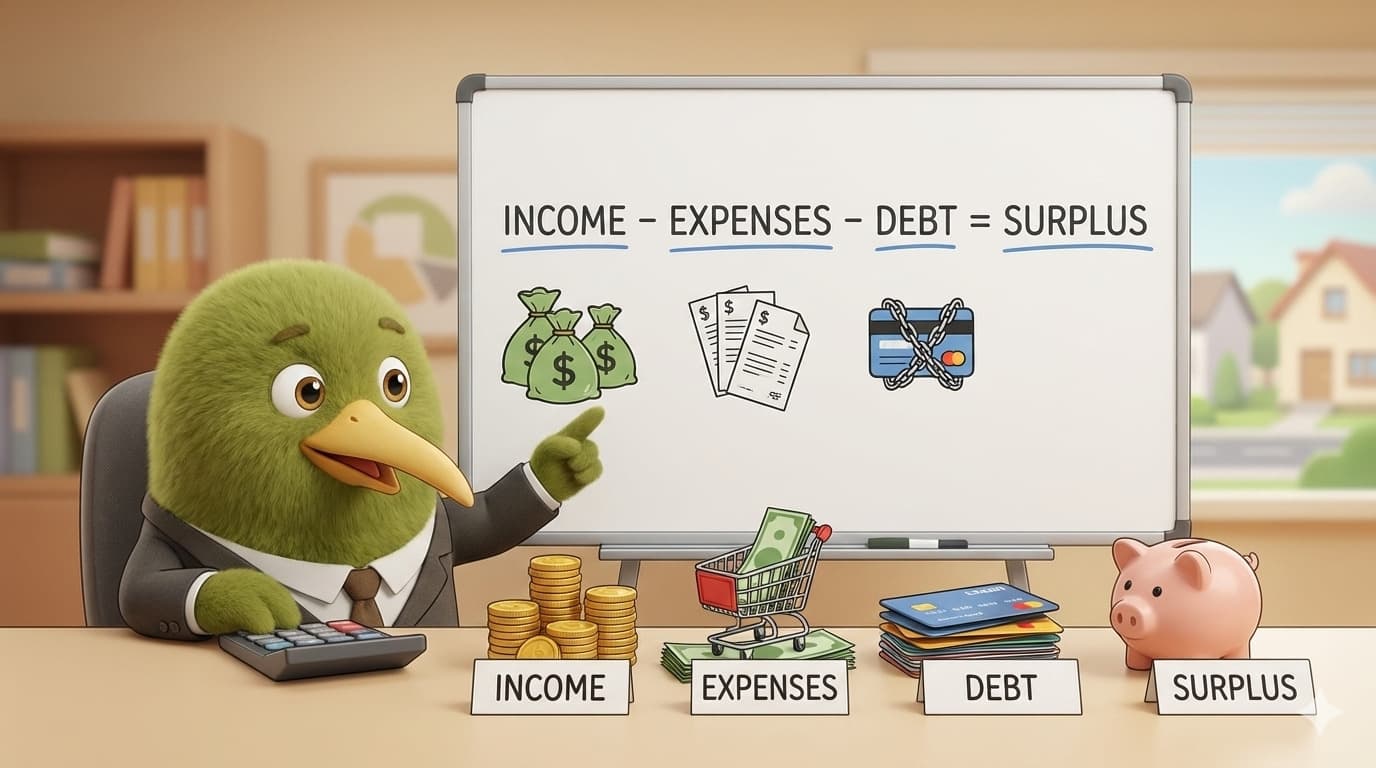

3. You Have Little or No Personal Debt and Understand Its Impact on Affordability

Personal debt plays a much bigger role in your home loan affordability than many first home buyers realise. Credit cards, personal loans, car loans, overdrafts, and even student loans can materially reduce how much a bank is willing to lend you. A commonly used rule of thumb is that every $10,000 of personal debt can reduce your home loan affordability by around $50,000. While this is not a fixed rule across all banks, it provides a useful illustration of how powerful debt reduction can be.

A strong sign that you are ready to buy is when you have intentionally reduced or eliminated non-essential personal debt. This does not mean you must be completely debt-free, but it does mean you understand the trade-offs. Choosing to clear a car loan, reduce credit card limits, or pay down personal loans can often unlock a significantly higher home loan limit without changing your income at all.

Reducing debt also improves your monthly cashflow. Lower commitments mean your mortgage repayments take up a smaller portion of your budget, which reduces financial stress and improves your long-term resilience. Buyers who enter home ownership with minimal personal debt often find it easier to cope with rate increases, maintenance surprises, and lifestyle changes such as having children or changing jobs.

If you have not yet addressed your personal debt position, this does not mean you are far from being ready. It simply means there may be a high-impact, practical step you can take that dramatically improves your readiness within a relatively short period of time. Clearing debt is often one of the fastest ways to move from "almost ready" to "genuinely ready".

4. You Are Mentally and Emotionally Ready for the Reality of Home Ownership

Financial readiness is only part of the picture. Buying your first home is emotionally demanding. It involves competition, rejection, negotiation, compromise, and uncertainty. A key sign of readiness is being mentally prepared for the process itself, not just the outcome.

This includes accepting that your first home may not be your forever home. Many first home buyers enter the market with expectations that are better suited to a second or third purchase. Being mentally ready means understanding that your first home is often about getting on the ladder, building equity, and learning the realities of ownership. Compromises around location, size, or condition are common, and emotionally mature buyers recognise this as part of the journey rather than a failure.

Mental readiness also means being prepared for setbacks. Offers fall through. Auctions can be intense. Properties that feel perfect can be lost to other buyers. If you are entering the market during a period of personal stress, instability, or burnout, the emotional load of buying may feel heavier than expected. A strong sign of readiness is feeling grounded enough to engage with the process without it taking over your wellbeing.

Another overlooked aspect of mental readiness is long-term commitment. Home ownership comes with responsibility. Maintenance, rates, insurance, and unexpected repairs are part of the package. Being ready means accepting that owning a home is not just about lifestyle freedom, but about stewardship of a significant asset and long-term financial commitment.

5. You Have Clarity on Your Affordability and a Realistic Buying Plan

A powerful sign that you are truly ready to buy your first home is having clarity on what you can afford and how you plan to buy. This goes beyond online calculators and rough guesses. It means you have a realistic understanding of your borrowing range, your deposit position, and the type of properties that fit your budget.

This clarity often comes from having your numbers reviewed professionally and understanding how bank policies, loan-to-value restrictions, and interest rate structures affect your options. Many first home buyers wait until they have found "the one" before they seek clarity on affordability, only to discover that their expectations and their borrowing capacity do not align. Being ready means doing this work upfront, before emotions enter the picture.

A buying plan also includes understanding the different ways you can buy. Auctions, price by negotiation, and new builds all come with different risks, conditions, and timelines. Being ready means knowing which pathways suit your risk tolerance and financial position. If auctions feel too stressful or risky, focusing on conditional purchases or new builds may be a better fit. Having this clarity before you start attending open homes can save you time, money, and emotional energy.

Clarity also extends to understanding your mortgage structure. Knowing whether you want the flexibility of offset or revolving credit, how you plan to manage fixed terms, and how future changes might affect your repayments is part of being genuinely ready. Buyers who have thought about these elements early tend to feel more confident and in control throughout the buying process.

What Readiness Really Means in the Real World

No first home buyer ever feels one hundred percent ready. There will always be uncertainty, trade-offs, and unknowns. Readiness is not about perfection. It is about alignment. When your finances, mindset, and plan are aligned with the reality of buying a home in New Zealand, the process becomes far more manageable and far less overwhelming.

Many buyers wait for the perfect market conditions, the perfect property, or the perfect financial situation. In reality, progress often comes from building readiness gradually and recognising when you are "ready enough" to take the next step. The key is to move forward intentionally, with clarity and support, rather than reacting emotionally to market noise.

If you are unsure where you sit on this readiness spectrum, practical tools such as our Home Readiness Quiz, a structured first home buying plan, and personalised affordability feedback can help turn uncertainty into direction. These tools can help you understand not just whether you can buy, but how to buy in a way that supports your long-term wellbeing and financial stability.

From Thinking About Buying to Taking Confident Action

Reaching the point where you are ready to buy your first home is less about ticking boxes and more about building confidence through understanding. When you have a workable deposit strategy, stable income, manageable debt, the right mindset, and a clear plan, the leap into home ownership feels far less daunting.

Instead of asking whether you should buy, the question becomes how you can move forward in a way that supports your future self. Take our Home Readiness Quiz to find out where you stand, or book a free consultation with one of our advisers to get personalised guidance.

Frequently Asked Questions

Related Articles

How Much Deposit Do I Need as a First Home Buyer?

Comprehensive guide on deposit options from 5% to 20% for first-home buyers. Learn about First Home Loans, YouOwn, and new build options.

How Do Banks Calculate Home Loan Affordability?

Essential guide on how banks calculate home loan affordability. Learn about income, expenses, debt, and the debt servicing test.

7 Steps to Get Mortgage-Ready for Your First Home

Essential 7-step guide to prepare for mortgage approval. Learn about documents, credit checks, employment verification, and expert strategies.

Want To Afford Your First Home Mortgage? Make Sure You Have a Monthly Surplus

Essential guide on maintaining a monthly financial surplus to afford mortgage repayments. Learn how to calculate and improve your surplus.