Get Your Savings On Track With PocketSmith, New Zealand’s Own Budgeting App

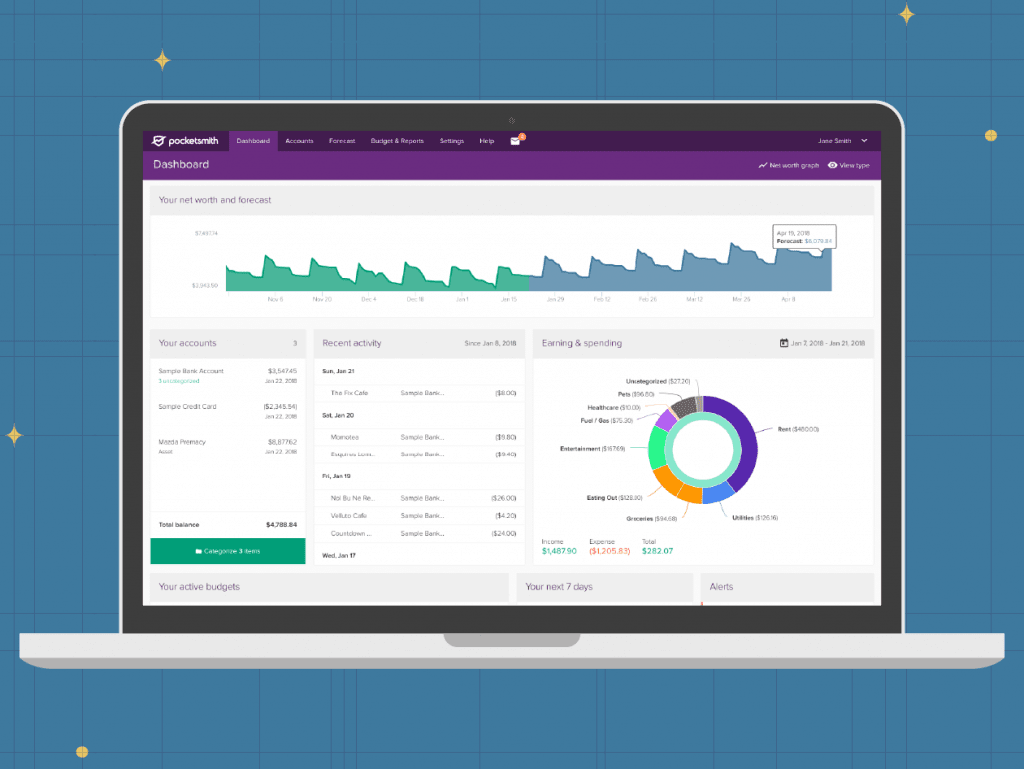

PocketSmith is a budgeting app that puts you in the driver’s seat with a clear and continuous view of your past, present, and future finances. From your dashboard, you can access the tools to manage your budgets and plan for a future horizon that PocketSmith will illustrate for you.

In the article below I will explain who we are and how to get started on your journey to take charge of your money.

So who is PocketSmith?

PocketSmith is personal finance software made right here in New Zealand and is used by people in over 190 countries to organise and plan their finances. PocketSmith is a web based budgeting app with a mobile companion so you can keep an eye on your budgets when you are out and about.

This is a personal finance tool that’s been refined over the last ten years to empower you to make the best decisions for your future.

Have a look at our short overview video and then get started!

How to get started

To get to know your financial landscape with PocketSmith there are a few essential steps you need to take. I promise you the steps are well worth it to truly understand your spending patterns and where they are taking you. The results may surprise, horrify, delight, or you may experience a combination of the three!

Either way, knowledge is power! In this case, the power is to know the future impact of the changes you can make now!

Setup Your Pocketsmith Account

So, firstly you need to create a PocketSmith account.

Members of the First Home Buyers Club can get 50% off the first two months of PocketSmith Premium for half price!

Get 50% off the PocketSmith Premium Monthly plan for the first two months.

Now that you have a PocketSmith account, you can begin setting up your budgets.

Import Your Financial Information

When you are ready to work with your own data, click the Demo Mode button in the top menu to reset the account. Then, simply follow the four-step checklist presented to you.

- Import your bank accounts. You can do this by setting up an automatic bank feed, if you prefer, you may import your bank statement files.

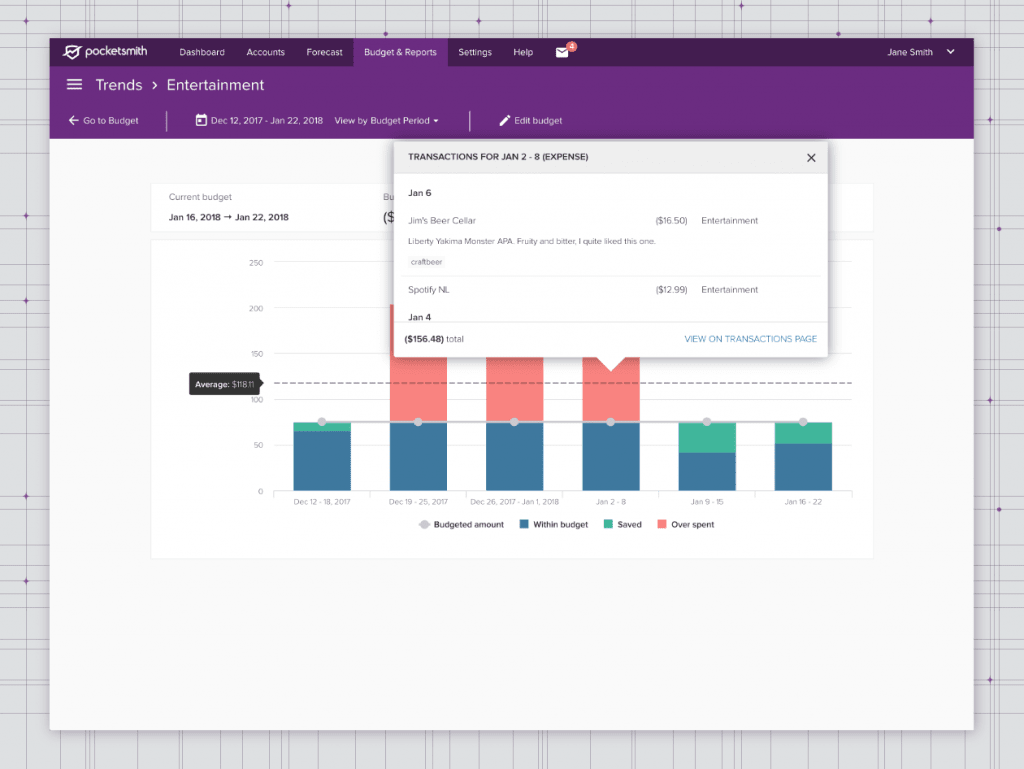

- Categorise your transactions (some will be auto-categorised)

- Create your budgets and forecast. You can customise your budgets or use the Auto-Budget tool which creates budgets based on your current spending, and then projects them forward to predict your future balances.

- Now, view your Financial digest and explore your spending habits!

And please remember: if you get stuck at any point, explore our help menu which has a tour, links to our Learn Center, and the option to contact our friendly, local support crew who are ready to help!

Tracking Your First Home Deposit

If you have a separate account for your deposit savings, you can make a budget for this and even add the interest rate to get a more accurate prediction.

With PocketSmith you can take control of your budgets, start saving and know what size mortgage you can afford to repay once you move into your first home.

We often underestimate the long-term power of making a few small changes now. Try changing some of your budgets and see in the calendar how much money that would turn into in 6 months, a year or 10 years!

Get A Realistic View Of Your Budget

Getting to know our finances can be a challenging process for many of us, and we may not always like what we initially see. Becoming aware of what you have and what you can do, is the first step towards your money actually being yours to use and choose.

Keep an eye out for updates from Pocketsmith about how to make the most of the budgeting app’s features that can help you get your deposit savings on track!