The Misconceptions On The Housing Market

The following article, putting some perspective on the current housing market was supplied by Nick Kearney, Director at Schnauer & Co Ltd.

The country’s national newspaper, The New Zealand Herald, seems to spend a lot of its time quoting current Auckland median house prices. Politicians are on record saying they want house prices to fall 30%, so that they’re affordable to more people. The possibility of falling housing market appears to fill some commentators with glee. I don’t understand why. And I’m very confident that the last thing the government will want is a fall of 30% in Auckland house prices.

Some Perspective On The Housing Market

House prices are not overly expensive in Huntly, Tokoroa or even Gisborne. My brother recently purchased a family home in Whakatane for a price well under $300,000. I have clients who have bought in Dunedin for about that same price, and with very good yields. The housing market in Rotorua is going well at the moment, but has been in the doldrums for about a decade.

So focus on a generic matter of “house prices” is misconceived. The real problem is the housing market in Auckland, and perhaps a couple of other main metropolitan centres.

It’s impossible in this article to give solutions, but I can give some perspective to counter the current negativity and offer some thoughts on where to from now.

If house prices in Auckland stay stagnant for a few years, or even go backwards, that is nothing to worry about. No one in this group should buy a house for an expected short term capital gain – it should be a long term decision.

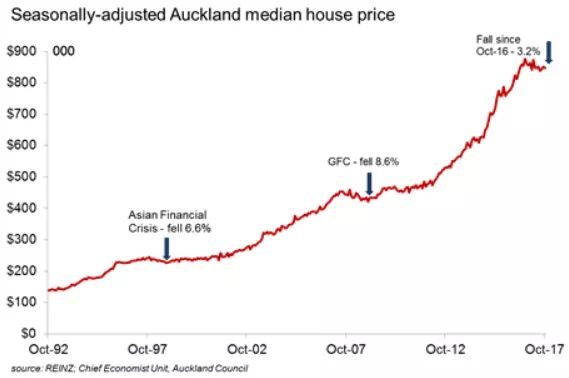

Just this week, the Chief Economist at Auckland Council issued a statement that reflected on figures showing a 3.2% fall in prices in Auckland from October 2016. He said that, when taken into perspective, this fall is just .1 (a tenth of one per cent!) lower than they were last month on October 2016 figures in seasonally adjusted terms. Here is the graph he produced that illustrates the 25 year trend.

Housing Supply

In terms of supply, if investors can’t see return in the Auckland housing market over the next few years, it is likely they will sell their rentals and seek returns elsewhere. This also applies for baby boomers, who have purchased with the long-term goal of focusing on their retirement. The threat of a capital gains tax and an extension to the bright-line test (from two years to five years) could also provide them with this incentive. All of this will provide homes for first home buyers.

The threat from the government of cutting back on immigration could also prompt investors to sell now. Again, this is good for first home buyers.

Economy

The Reserve Bank will eventually relax the tough lending restrictions, which again is good for first home buyers.

I’ve been through the depressed market in 1997-2000 after the Asian Financial crisis, and the GFC in 2008/09. The very large percentage of house owners survived those episodes. They just bunkered down. I can’t see anything as dramatic happening in the next few years, but these are still weird times.

A lot of money was pumped into the world economy after the GFC through Quantative Easing, and it was expected to result in inflation, but we aren’t seeing any. Interest rates are predicted to remain very low for a few years yet. That is one reason why existing borrowers will cope. The other is unemployment being under 5%. That means 95% of the working population are in jobs. The economy is strong. It is absolutely against any politician’s interest to make things bad. Their prospect of re-election is at risk with that strategy.

In Closing

It’s not gloomy if you take a long term view to the housing market, as the graph suggests you should. Yes, you might get a better deal in two years’ time, but between now and then all you are doing is contributing to someone else’s mortgage. And interest rates are very low at the moment, so buying and locking in a five year interest rate could be the strategy.

My advice for first home buyers is to stay away from click-bait Herald headlines and focus on the long term.

Fiona Tate November 22, 2017 Blog, Tips for First Home Buyers